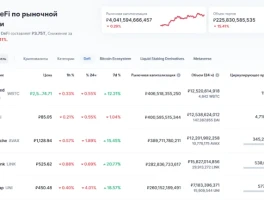

Okay, November 20, 2025. Apparently, it was a bloodbath in DeFi-land. Two outta 23 tokens in the green YTD? That ain't good. Down 37% QTD? Someone get the smelling salts. We're talking DEX, lending, yield... the whole damn shebang. It's like watching a slow-motion train wreck, except the train is made of hopes and dreams, and the wreckage is your portfolio.

And then there's Bitcoin. Spot ETFs hemorrhaging billions. $3.79 billion gone in November alone! Biggest outflow since February? Sounds like someone's hitting the panic button, hard. But wait, who's buying the dip?

El Salvador. Of course.

Look, I gotta hand it to Bukele. He's either the smartest guy in the room or the most reckless gambler on the planet. Maybe both. Buying 1,090 BTC at ~$90k each? That's either visionary or... well, you know. They're sitting on nearly 7,500 BTC now. Is this genius or insanity? I honestly can't tell anymore.

TradFi Grandmas, KYC Nightmares, and Security Theater

The Curious Case of GoPlus and the Ethereum ETF Tease

Meanwhile, BlackRock's sniffing around Ethereum ETFs. They registered the iShares Staked Ethereum Trust in Delaware. Because *that's* what we need – more TradFi giants dipping their toes into crypto. It's like watching your grandma try to use TikTok. Cute at first, then just embarrassing.

And Mastercard's getting in on the action, too. Expanding their Crypto Credential system to self-custody wallets, using Polygon. Human-readable aliases tied to KYC? I can already hear the privacy maximalists screaming. It's all about control, baby. Always has been.

But hey, at least *someone's* making money. GoPlus has raked in $4.7M in revenue. Their app's the big earner, followed by the SafeToken Protocol. Token Security API averaging nearly a billion calls a month? So, people are scared, basically. They're throwing money at security audits like it's going out of style.

"Humble Crypto Investors"? Yeah, Right.

Market Sentiment: Humility and Hopium

Investor sentiment is "confused, resolved, and humble." Confused? Yeah, me too. Resolved? About what, exactly? Humble? Please. This is crypto. Humility is a foreign language here.

And ofcourse there are whispers of "end-of-cycle" behavior weighing on Bitcoin's price. Self-fulfilling prophecy, anyone?

Some folks are flocking to "safer" DeFi names like HYPE and CAKE. Because nothing says "safe haven" like a meme coin and a pancake-themed DEX. Let's be real, it's all relative. When the whole market's on fire, even the slightly less flammable stuff looks appealing.

Speaking of fire, altcoins are holding up okay, apparently. Performing in line with, or even *better* than, BTC since that October crash. Maybe it's time to ditch Bitcoin altogether and go all-in on DogeCoin. I'm kidding... mostly.

Lending and yield names are getting pricier, relatively speaking. Which makes sense. People are scrambling for stable returns in a sea of red. It's like musical chairs, except the chairs are made of yield farms, and the music is a death metal remix of "To the Moon."

This Ain't a Dip, It's a Dive